Postal Fraud Statute Used To Cancel Arson Scheme

features

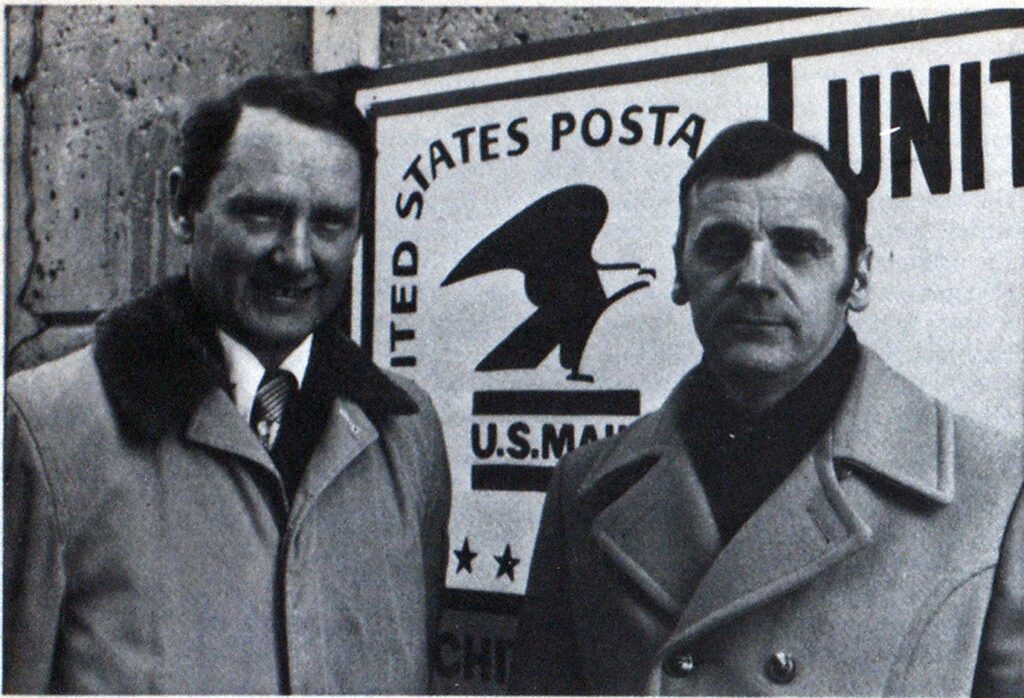

—photo by the author.

A seven-year multi-state arson scheme recently was stopped by the United States Postal Service after fire investigators were unsuccessful.

The unique case offers another approach to the conviction of certain suspects in complex situations or when arson is difficult to prove in court.

Several unsuspecting insurance companies and fire departments became involved in the series of seemingly unrelated commercial fires that stretched from Canada to Texas and as far west as California.

Arson might have gone unpunished except for an informal complaint to the police in rural Minnesota. The story was relayed to the state fire marshal’s office, but the fire was not in Minnesota. Early in 1977, the state attorney’s office contacted the U.S. Postal Service in St. Paul, where postal inspectors became interested because the U.S. mail might have been used to defraud an insurance company.

The broad-based postal fraud statute can be invoked whenever a fire insurance claim is mailed, even if it’s only across town, explained Mel Vander Meer and Dwain Thomsen, postal inspectors who worked on the case. Crossing state lines is not a requirement. The trail in this scheme, however, covered several states, where nine suspicious fires were found to involve approximately $500,000 in fraudulent insurance claims traceable to the same three persons.

Evidence gathered by the postal inspectors indicated it all began in 1970 with a simple but well-planned house fire at Fargo, N. D., that resulted in a fire insurance payment of more than $10,000 to an energetic middle-aged agribusinessman who wanted to erect a commercial establishment on the lot occupied by the house.

This success led the conniving agribusinessman and a farmer friend to put several pieces of equipment, including a bulldozer, in a large building they insured on an isolated farm in northern Minnesota. They also placed a pile of newspapers in a corner of the building, and that was the origin of a planned fire which destroyed the structure late in 1970. The two men collected $35,000 in fire insurance.

Propane causes explosion

In 1971, the industrious agribusinessman acquired a vacant lumberyard building in a small town in southern Manitoba, Canada. He and another friend, who was a businessman, had several loads of junk parts and dismantled equipment they owned, including old propane-fueled farm tractors, hauled across the border and dumped in the building. They also took out fire insurance on the structure and contents, with five Canadian insurance companies.

Arrangements were made for a torch to fire the building shortly before Christmas. When this attempt failed, the agribusinessman’s friend apparently went into the building and started a small fire and then opened valves of the previously filled propane tanks on the dismantled farm tractors. When the propane fumes reached the open flames, there was a fiery explosion that destroyed the building in the middle of the night.

The agribusinessman not only collected $75,000 in fire insurance, but made arrangements with an unsuspecting fire adjuster to clean up the site in exchange for any salvage he might claim, namely the used parts and equipment.

Farm ‘sale’ shields arson

In an attempt to make a fast buck that would help his business friend pay off a debt, the agribusinessman next deviously decided to “sell” a farm he owned in northern Minnesota to a naive area farmer on a contract for deed in 1972.

In accordance with the purchase agreement, the farmer insured the farm buildings and their contents. Early in

1973, the barn and some used tractors and construction equipment that had been put inside by the agribusinessman and his business partner were destroyed by a fire. The contract for deed was canceled. The agribusinessman kept the farm, and fire insurance claims of nearly $95,000 were paid on the false assumption that the blaze was caused by an accidental short in the battery cable of an old tractor in the barn.

Two months later, fire destroyed a remote old building in eastern North Dakota that contained used parts and equipment, including at least three old farm tractors with propane tanks. A $75,000 check, part of the paid fire insurance claim, was later endorsed over to the agribusinessman.

Business front set up

Evidence indicates that in 1974, used parts and equipment, including propane-fueled tractors similar to those which burned in the North Dakota and Canadian fires, were hauled to a large old metal building the agribusinessman acquired south of Fresno, Calif. As a front for insurance purposes, he engaged a mildly interested Los Angeles man to operate a used farm equipment sales business in the building.

Before the business opened, the building and contents were destroyed by a suspicious fire in 1975, and the agribusinessman received nearly $70,000 in fraudulent fire insurance payments.

Fire inspectors suspected arson because there was no physical explanation for the fire, but they could not prove arson. Circumstantial evidence from a rental car agency’s records suggested that a friendly farmer may have started the fire.

Sunflower seeds burned

Investigation also revealed that while the parts-burning scheme was in progress, the busy agribusinessman and a farmer accomplice tried unsuccessfully to interest Kansas and Colorado farmers in growing sunflower seeds which the two schemers had hauled from North Dakota. After three or four years, the seeds became old and wet as they were moved from storage in a store basement to a quonset hut to a vacant barn in the open spaces of Graham County in western Kansas, far removed from the nearest fire department.

In May 1975, the agribusinessman’s farmer accomplice and another front man insured the barn and its contents of deteriorating sunflower seeds. Two months later, the old barn and the seeds were destroyed in a fire and the two men collected $40,000 in fire insurance claims.

A similar fire occurred a year later in May 1976 on a rundown farmstead in Prowers County, Colo. This time, however, the agribusinessman apparently enlisted the aid of his business partner, who had commercial experience in the hauling of sunflower seeds.

Policy canceled too late

A local insurance agent was persuaded to write a fire insurance policy for $20 down. However, the insurance company refused to insure the building because of its poor condition and lack of fire protection and mailed a notice of cancellation, effective two weeks later.

Three days after the cancellation notice was mailed, the old wooden building, filled with sunflower seeds of inflated value, mysteriously burned to the ground. A claim for $56,000 was filed with the insurance company.

In June 1976, after the normal planting season, the agribusinessman and his same business partner bought $7000 worth of sunflower seeds, using an insufficient fund check from a bank account they had established in British Honduras, and took them to Dimmitt, Texas, where their farmer accomplice had rented a vacant laundry building for storage until the seeds presumably could be sold to farmers.

Insurance increased

Fire insurance on the rented building containing the seeds was raised from $73,000 to $109,000 in July. Two days later, the building and contents burned in a suspicious fire, but arson could not be proved.

For various reasons, the insurance company reduced the fire claim from $109,000 to a payment of $87,000. This gave the trio an $80,000 profit on their $7000 purchase of sunflower seeds.

It also brought them into federal court—not for arson, but on charges of using the U.S. mail to defraud seven insurance companies. In June 1978, the agribusinessman and one accomplice, the friendly farmer, pleaded guilty to a criminal information and they were sentenced to three years in federal prison. The business partner pleaded innocent and final disposition of his case is pending, according to postal authorities.

It would have been virtually impossible for a local investigator in any one of these fires to prove or even suspect that a multi-state arson ring was involved, postal inspectors Vander Meer and Thomsen stated.

“Yet, with the rapid rise in known arson fires throughout the country, one might wonder how unusual this case is,” Vander Meer commented.

“Our investigation revealed that the focus of the arson investigators probably was too narrow. They concentrated on looking for evidence that could prove the crime of arson and didn’t fully consider the broader possibility of mail fraud,” Thomsen explained.

Fraud consideration

“It may be that harried fire investigators sometimes have to leave that angle for the insurance companies to pursue,” Thomsen observed. “But this case demonstrates that fraud should be a primary consideration in many fire investigations.”

In this instance, the most incriminating evidence was not found on the firegrounds. It included the insurance claims filed and paid, and especially the documents used to support these claims. For example, self-serving consignment agreements were always used to establish the value of farm machinery, and deceptive promissory notes were arranged and relied on to reinforce claims made in the sunflower seed fires.

“The fraudulent nature of the consignment agreements and promisory notes made them as incriminating as a trailer, a gas can or other obvious clue found at the scene of an arson fire,” Vander Meer explained.

Postal inspectors can help

Both Vander Meer and Thomsen pointed out that postal inspectors are available to assist fire investigators when there are questions or suspicions regarding the possibility of mail fraud.

If, as this successful prosecution illustrates, there is any substance to go on, the postal inspection service can help bring the investigative resources of the federal government to bear on the case, they said, noting that this was an intent of the recent congressional investigation into the crime of arson.

In addition to supporting the arson investigation from a different perspective, postal inspectors sometimes can uncover other related crimes beyond the scope of the fire investigator.

While delving into this case, for example, the two postal inspectors also found evidence linking the trio with illegal grain transactions and the buying and selling of stolen equipment. One of them even went so far as to collect $25,000 from credit life insurance placed on the life of an employee terminally ill with cancer.