By Diana Palmieri

I am guessing they have been quite moody lately. Market volatility on Wall Street is all the talk for this summer so far. The week of August 8-August 12 was the most dizzying and volatile, even to some veteran traders. Here’s the week in a nutshell:

I am guessing they have been quite moody lately. Market volatility on Wall Street is all the talk for this summer so far. The week of August 8-August 12 was the most dizzying and volatile, even to some veteran traders. Here’s the week in a nutshell:

Monday 8/8/11: Dow is down 635 points.

Tuesday 8/9/11: Dow is up 420 points.

Wednesday 8/10/11: Dow is down 520 points.

Thursday 8/11/11: Dow is up 413 points.

Friday 8/12/11: Dow is up 125 points.

Wow, pass the Dramamine. Makes you want to stuff money back into your mattress. Not so fast–have you heard of the term Beta?

Beta is a useful tool to measure the volatility and risk of individual stocks and mutual funds. Just so we are clear, determining an asset’s Beta does not mean you won’t lose money; it will just help you assess risk before purchasing it. Beta is used in the capital asset pricing model (known as CAPM), which calculates the expected return of an asset based on its Beta and expected market returns. I am sure you all might be able to guess which sector of the market might carry the highest Beta. If you guessed financials or technology stocks, you would be correct. Stocks with the lowest Beta generally are consumer staples and utilities.

Beta seems like something difficult to understand, but it’s really not. In fact, it can be found on the same page as the Price Earnings Ratio on a major stock data provider such as Yahoo or Google. In general, Beta is a term used to describe a stock’s tendency to move in tandem with a particular market index (basically how moody it’s been), which by definition has a Beta of 1. A Beta of 1 indicates that the security’s price will move with the market. A Beta of less than 1 means that the security will be less volatile than the market. A Beta of greater than 1 indicates that the stock’s price will be more volatile than the market. For example, if a stock’s Beta is 1.2, it’s theoretically 20% more volatile than the market. Below are some examples of stocks with high and low Beta as related to the S&P 500.

10 Stocks in the S&P 500 with the Highest Beta:

|

| (Source: www.cnbc.com – Best Stocks For A Volatile Market 8/5/11) |

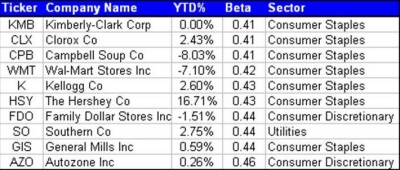

10 Stocks in the S&P 500 with the Lowest Beta:

|

Taking a look at Chart 1 (the highest Beta stocks), we see Monster Worldwide has a Beta of 1.97. This tells us that Monster Worldwide is 97 percent more volatile than the S&P 500 Index. Conversely, Southern Company on Chart 2, lowest Beta stocks, is 56 percent less volatile than the S&P 500 Index. Now let’s calculate an actual return by using a tech stock with a Beta of 2 (simply take the market return and multiply by Beta).

Let’s say the market performs and provides a 10-percent return to ordinary investors. Taking a tech stock with a Beta of 2 will provide a 20-percent return (higher risk, higher return). Conversely, if the market underperforms and provides a negative 8 percent return, then our tech stock with a Beta of 2 will provide a negative 16-percent return (ouch–higher risk, probability of lower returns!). Now flip to owning a low Beta utility stock of .60; using a negative 10-precent return of the market, your stock would have eased negative 6 percent (instead of negative 10 percent).

Beta is just one of many risk measures I use myself in determining the purchases of stocks for clients. Bear in mind there are many other things to consider when purchasing a stock or mutual fund; don’t just rely on Beta alone. Do your homework. We are in an ever-changing world, and market environments are going to be quite volatile, in my opinion, through the end of the year. There are many tools out there that can help you, along with the help of an advisor, to map out this very bumpy ride we are on and most likely will be for the foreseeable future.

The information contained in this article is not intended to constitute legal, accounting, tax, investment, consulting or other professional advice or services. For specific information that applies to your circumstances you should consult a qualified tax advisor or independent professional advisory.

Diana Palmieri is dually registered with Vanderbilt Securities LLC and H Beck Inc., which are unaffiliated. Securities offered through Vanderbilt Securities LLC, member SIPC/FINRA/MSRB.